Shopify Capital Loans: Are They Worth It for Growth?

As Shopify Capital Loans: Are They Worth It for Growth? takes center stage, this opening passage beckons readers with casual formal language style into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

Providing clear and descriptive information about the topic, this paragraph sets the stage for an insightful discussion on Shopify Capital Loans.

Overview of Shopify Capital Loans

Shopify Capital Loans are a financing option offered by Shopify to eligible e-commerce businesses looking to grow and expand. These loans are designed to provide quick and convenient access to capital without the hassle of traditional loan applications.

How Shopify Capital Loans Work

Shopify Capital Loans work by providing eligible merchants with a lump sum of money upfront, which is then repaid through a fixed percentage of daily sales made through the Shopify platform. The repayment amount fluctuates based on the business's sales volume, making it a flexible and manageable financing option.

Eligibility Criteria

- Active Shopify store with a certain minimum sales threshold

- Good standing with Shopify (no outstanding disputes or violations)

- History of consistent sales and revenue

- Located in a supported country where Shopify Capital operates

Benefits of Shopify Capital Loans

- Quick access to funds without a lengthy application process

- Flexible repayment based on daily sales volume

- No fixed monthly payments or interest rates

- Opportunity to invest in growth initiatives such as marketing, inventory, or product development

Pros and Cons of Shopify Capital Loans

When considering Shopify Capital Loans for business growth, it is essential to weigh the advantages and disadvantages to make an informed decision.

Advantages of Choosing a Shopify Capital Loan

- Quick and Easy Application Process: Shopify Capital Loans have a streamlined application process compared to traditional bank loans, making it convenient for businesses in need of fast funding.

- No Fixed Monthly Payments: Instead of fixed monthly payments, Shopify Capital Loans are repaid through a percentage of daily sales, allowing for flexibility based on business performance.

- No Personal Guarantee Required: Unlike traditional bank loans that may require a personal guarantee, Shopify Capital Loans are based on your business's sales history on the platform.

- Access to Funds for Growth: Shopify Capital Loans provide access to capital that can be used for various business growth initiatives, such as inventory expansion, marketing campaigns, or equipment upgrades.

Potential Drawbacks of Shopify Capital Loans

- Higher Fees and Interest Rates: Shopify Capital Loans may come with higher fees and interest rates compared to traditional bank loans, which could increase the overall cost of borrowing.

- Limited Borrowing Amounts: The amount you can borrow through a Shopify Capital Loan may be limited based on your business's sales history on the platform, potentially restricting access to larger funding amounts.

- Integration Limitations: Shopify Capital Loans are only available to businesses operating on the Shopify platform, which could be a limitation for those using other e-commerce platforms.

Comparison with Traditional Bank Loans

- Ease of Application: Shopify Capital Loans typically have a simpler and faster application process compared to traditional bank loans, which often involve extensive documentation and credit checks.

- Requirements: While traditional bank loans may require collateral or a personal guarantee, Shopify Capital Loans are based on your business's performance on the Shopify platform, making them accessible to businesses without significant assets.

- Repayment Structure: Unlike traditional bank loans with fixed monthly payments, Shopify Capital Loans are repaid through a percentage of daily sales, providing more flexibility in repayment based on business revenue.

How to Apply for Shopify Capital Loans

To apply for a Shopify Capital Loan, you need to follow a straightforward process that can help increase your chances of approval and streamline the disbursement of funds. Here are the steps involved:

Step 1: Check Eligibility

Before applying for a Shopify Capital Loan, ensure that you meet the eligibility criteria set by Shopify. This may include factors such as your sales history, business performance, and other requirements.

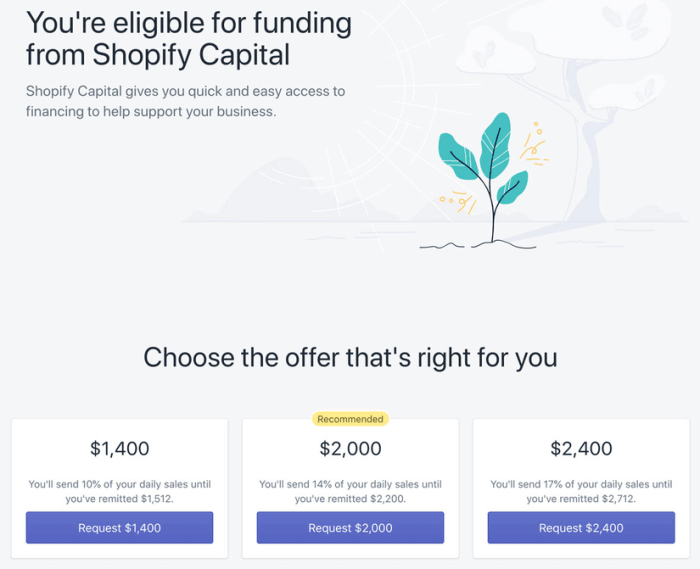

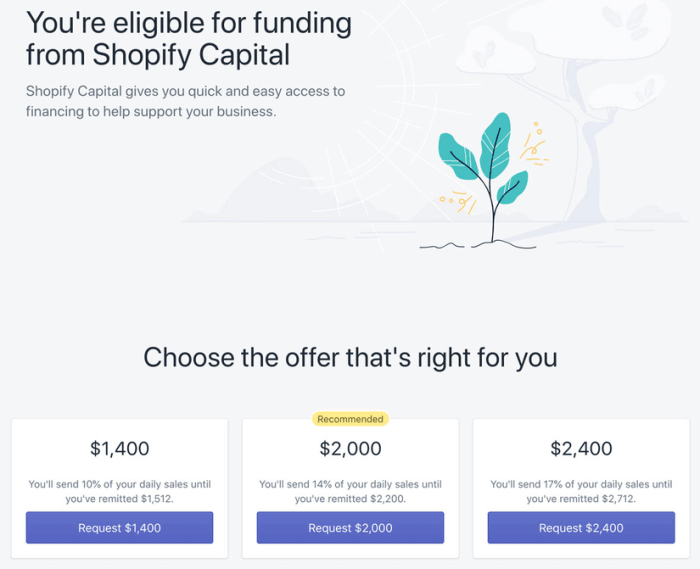

Step 2: Access Your Capital Offer

Once you are deemed eligible, Shopify will present you with a capital offer based on your business performance. Review the offer carefully to understand the terms, including the loan amount, repayment structure, and fees

Step 3: Accept the Offer

If you find the capital offer suitable for your business needs, you can proceed to accept it through your Shopify account. Be sure to read and agree to the terms and conditions Artikeld by Shopify.

Step 4: Provide Necessary Information

After accepting the offer, you may need to provide additional information or documentation to complete the loan application process. This may include financial statements, business details, and other relevant paperwork.

Step 5: Await Approval and Disbursement

Once you have submitted all required information, Shopify will review your application and determine if you qualify for the loan. If approved, the funds will be disbursed to your account within a specified timeline.

Tips for Optimizing Your Loan Application

- Ensure your sales history and business performance metrics are in good standing.

- Provide accurate and up-to-date financial information to support your application.

- Review the terms of the capital offer carefully before accepting it.

- Respond promptly to any requests for additional information or documentation.

Timeline for Approval and Disbursement

Approval and disbursement timelines for Shopify Capital Loans can vary depending on the completeness of your application and the review process. Typically, successful applicants receive funds within a few business days after approval.

Case Studies of Businesses Using Shopify Capital Loans

Utilizing Shopify Capital Loans can be a game-changer for businesses looking to grow and expand. Let's take a look at some success stories of businesses that have benefited from these loans.

Example 1: Clothing Boutique

A clothing boutique that specializes in handmade garments used a Shopify Capital Loan to increase their inventory and expand their online presence. With the additional funds, they were able to launch new product lines and invest in marketing strategies. As a result, their online sales doubled within a few months, leading to increased profitability and brand awareness.

Example 2: Home Decor Store

A home decor store took advantage of a Shopify Capital Loan to renovate their physical store and enhance their e-commerce platform. By improving the overall shopping experience for customers, they saw a significant increase in foot traffic and online sales.

The loan helped them streamline their operations and offer a wider range of products, ultimately boosting their revenue and customer satisfaction.

Example 3: Electronics Retailer

An electronics retailer used a Shopify Capital Loan to launch a new line of innovative tech products. The funds allowed them to secure bulk discounts from suppliers and ramp up their marketing efforts. This strategic move resulted in a surge of sales, with the new product line becoming a bestseller in their niche market.

The loan not only accelerated their growth but also solidified their position as a leading player in the industry.

End of Discussion

Concluding the discussion on Shopify Capital Loans: Are They Worth It for Growth? this paragraph summarizes key points and leaves readers with a compelling final thought.

FAQ Summary

What are the eligibility criteria for accessing Shopify Capital Loans?

The eligibility criteria typically include factors like sales history, account health, and fulfillment metrics on Shopify.

How do Shopify Capital Loans compare to traditional bank loans in terms of ease and requirements?

Shopify Capital Loans are often easier to access and have more flexible requirements compared to traditional bank loans.

What is the timeline for approval and disbursement of funds for successful applicants?

Once approved, funds from a Shopify Capital Loan are usually disbursed within a few business days.