Server Hosting Insurance Options for Small Business Owners: Ensuring Protection for Your Digital Assets

As Server Hosting Insurance Options for Small Business Owners takes center stage, this opening passage beckons readers with casual formal language style into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

In today's digital age, small business owners face various risks when it comes to server hosting. It's crucial to understand the importance of having insurance tailored to this specific industry to safeguard your business from potential financial losses. Let's delve into the realm of Server Hosting Insurance Options for Small Business Owners and explore the key factors to consider.

Table of Contents

ToggleUnderstanding Server Hosting Insurance

Insurance for small business owners in the server hosting industry is crucial to protect against unforeseen risks and potential financial losses. By understanding the importance of insurance and the types of coverage available, business owners can safeguard their operations and assets.

Common Risks Associated with Server Hosting

- Hardware failure: Insurance can cover the costs of replacing or repairing servers and other hardware in case of malfunctions.

- Data breaches: Insurance can help mitigate the financial repercussions of data breaches and cyber attacks, including legal fees and customer notification costs.

- Downtime: Insurance can provide coverage for lost income and expenses incurred during periods of server downtime.

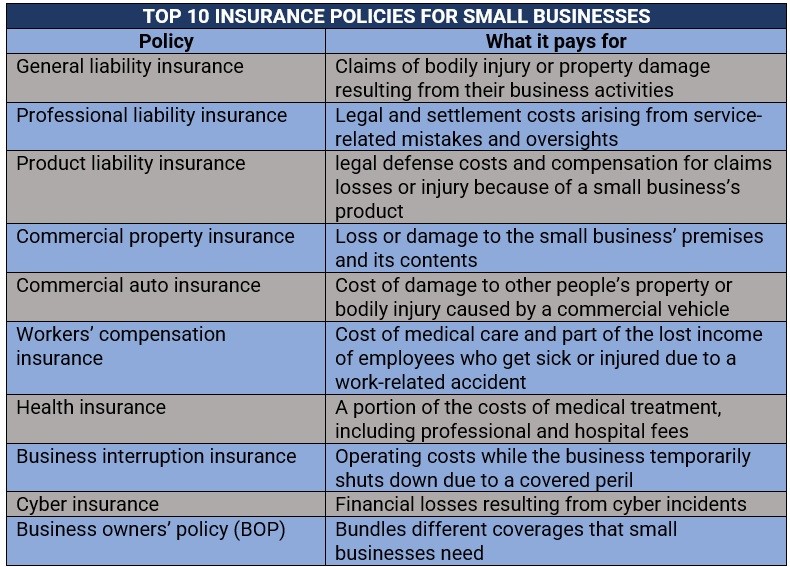

Types of Insurance Options Available

- General Liability Insurance: Protects against third-party claims of bodily injury, property damage, and advertising injury.

- Business Interruption Insurance: Covers lost income and expenses during periods when business operations are interrupted due to covered perils.

- Cyber Liability Insurance: Helps cover costs associated with data breaches, cyber attacks, and other cyber-related incidents.

- Errors and Omissions Insurance: Protects against claims of professional negligence or failure to perform services as promised.

Benefits of Server Hosting Insurance

Server hosting insurance offers a wide range of benefits for small business owners looking to protect their operations and finances.

Financial Protection

- Insurance can cover the costs associated with data breaches, cyber attacks, or server downtime, helping small businesses avoid significant financial losses.

- Having insurance in place can provide peace of mind knowing that any unexpected events impacting server hosting will be covered.

Coverage Options

- Different insurance policies offer varying levels of coverage, allowing small business owners to choose a plan that best fits their specific needs and budget.

- Some policies may include coverage for business interruption, legal expenses, and data recovery, offering comprehensive protection for server hosting operations.

Risk Mitigation

- Insurance can help small business owners mitigate risks associated with server hosting, ensuring that they are prepared for any potential threats or disruptions.

- By investing in insurance, business owners can focus on growing their operations without worrying about the financial implications of server-related incidents.

Factors to Consider When Choosing Insurance

When selecting server hosting insurance for their small businesses, owners need to carefully consider several key factors to ensure they have the right coverage in place.

Coverage Limits

- Understanding the coverage limits of the insurance policy is crucial. Make sure the limits align with the value of your server hosting equipment and potential liabilities.

- Consider any additional coverage options that may be necessary based on your specific business needs.

Premiums and Deductibles

- Compare premiums from different insurance providers to find a balance between cost and coverage.

- Understand how deductibles work and choose a deductible amount that you can comfortably afford in the event of a claim.

Reading the Fine Print

- Always read the fine print of the insurance policy to understand any exclusions that may apply.

- Pay attention to details such as what is covered, what is not covered, and any specific conditions that need to be met for coverage to apply.

Tips for Finding the Right Insurance Provider

Finding the right insurance provider for server hosting can be crucial for small business owners. Here are some tips to help you navigate this process effectively.

Checking Reputation and Financial Stability

When looking for an insurance provider, it is essential to check their reputation and financial stability. A reputable insurance provider will have a track record of reliability and customer satisfaction. Additionally, ensuring the provider is financially stable will give you peace of mind knowing they can fulfill their obligations in case of a claim.

Obtaining Quotes and Comparing Them

One of the best ways to find the right insurance provider is by obtaining quotes from multiple companies and comparing them. This will allow you to assess the coverage options, premiums, and any additional benefits offered by each provider. By comparing quotes, you can make an informed decision based on your specific needs and budget.

Epilogue

In conclusion, Server Hosting Insurance Options for Small Business Owners offer a vital shield against unforeseen circumstances that could jeopardize your digital assets. By understanding the risks, benefits, and factors to consider when choosing insurance, small business owners can make informed decisions to protect their ventures in the ever-evolving digital landscape.

FAQ Overview

What are the common risks associated with server hosting that insurance can cover?

Common risks include data breaches, server downtime, and cyber-attacks, which can lead to financial losses. Insurance can cover these risks to ensure business continuity.

How do coverage limits, premiums, and deductibles play a role in decision-making when choosing server hosting insurance?

Coverage limits determine the maximum amount an insurance company will pay for a claim, premiums are the cost of the insurance policy, and deductibles are the out-of-pocket expenses. Understanding these factors is crucial to selecting the right insurance.

What are some strategies for small business owners to find reputable insurance providers specializing in server hosting?

Researching online reviews, checking industry certifications, and seeking recommendations from other business owners can help in finding reputable insurance providers in the server hosting sector.

Featured Posts

- eCommerce SEO tips for higher Google rankings: A Comprehensive Guide

- Mobile eCommerce optimization best practices: Enhancing Your Online Store for Mobile Users

- How to Handle Returns and Refunds in International eCommerce: A Comprehensive Guide

- Social commerce: Using TikTok & Instagram to boost eCommerce sales

- Top shipping solutions for cross-border eCommerce: Enhancing Global Trade

Tags

2025 predictions (1) Asian market (1) Asian markets (1) Cross-border eCommerce (1) Digital Marketing (5) Ecommerce (13) eCommerce Brands (1) eCommerce strategies (1) Energy Efficiency (2) Entrepreneurship (2) global expansion (1) Influencer Marketing (1) Insurance (2) insurance coverage (2) Interior Design (2) international growth (1) Multi-language eCommerce (1) online business (4) online shopping (2) Optimization (2) outdoor design (2) Personalization (2) remarketing (1) Social Media Influencers (1) Sustainable Living (2) technology (3) trust signals (1) user experience (2) US market (1) website optimization (1)

Categories

- Business (7)

- Business Insurance (1)

- Digital Marketing (4)

- Digital Security (1)

- E-commerce (1)

- eCommerce (4)

- eCommerce Business (1)

- eCommerce Industry (1)

- eCommerce Strategies (1)

- eCommerce Tips (1)

- General (40)

- Home & Garden (1)

- Home Improvement (5)

- Home Insurance (1)

- Home Maintenance (1)

- Insurance (1)

- Online Security (1)

- Outdoor Design (1)

- Professional Services (1)

- Property Management (1)

- Real Estate (1)

- Tech (1)

- Technology (2)

- Web Design (1)