How to Refinance Your Car Loan Without Hurting Credit Score

As How to Refinance Your Car Loan Without Hurting Credit Score takes center stage, this opening passage beckons readers with casual formal language style into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

The content of the second paragraph that provides descriptive and clear information about the topic

Understanding Car Loan Refinancing

Car loan refinancing is the process of replacing your current car loan with a new loan, typically with better terms such as a lower interest rate or monthly payment. This can help you save money over the life of the loan or make your monthly payments more manageable.

Benefits of Car Loan Refinancing

- Lower Interest Rates: Refinancing can help you secure a lower interest rate, reducing the amount of interest you pay over time.

- Lower Monthly Payments: By extending the loan term or securing a lower interest rate, refinancing can lower your monthly payments, providing financial relief.

- Improved Credit Score: Making timely payments on a refinanced loan can positively impact your credit score over time.

Potential Impact on Interest Rates and Monthly Payments

When you refinance your car loan, the new loan terms can either increase or decrease your interest rate and monthly payments. Factors such as your credit score, the current market interest rates, and the length of the new loan term can all influence these changes.

It's essential to carefully consider these factors before deciding to refinance your car loan to ensure it aligns with your financial goals.

Factors to Consider Before Refinancing

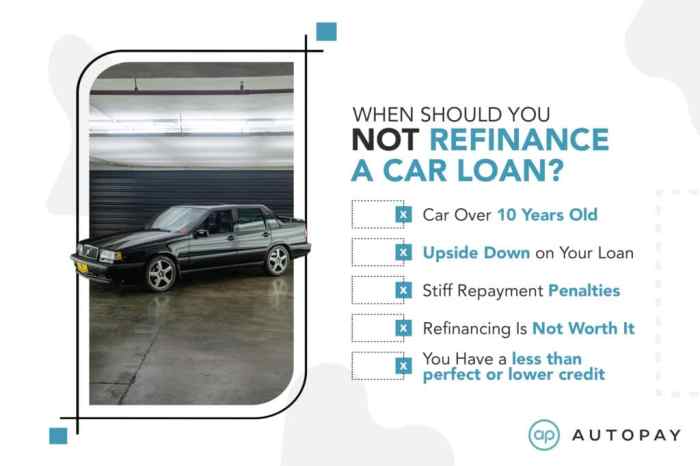

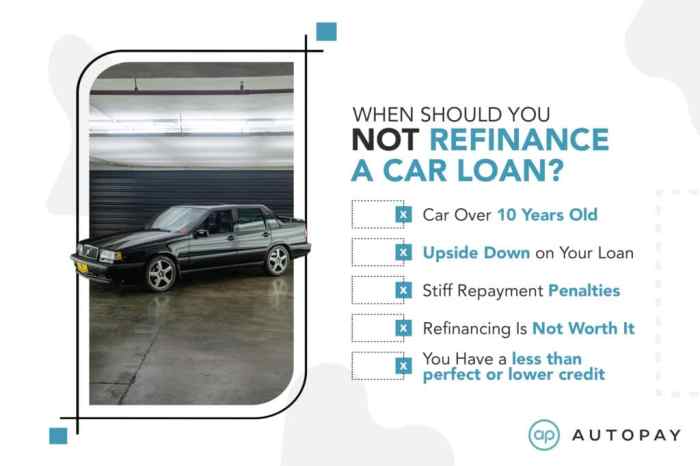

Before deciding to refinance a car loan, there are several key factors that you should take into consideration to ensure that it is the right move for you. One of the most important factors is your credit score, as it plays a significant role in the refinancing process.

Credit Score

Your credit score is a crucial factor when it comes to refinancing a car loan. Lenders will use your credit score to determine the interest rate they can offer you. If your credit score has improved since you initially took out the loan, you may be eligible for a lower interest rate when refinancing.

On the other hand, if your credit score has decreased, you may not be able to secure a better rate, or you may even be denied refinancing altogether. It's essential to check your credit score before applying for refinancing to understand where you stand.

Current Interest Rates and Market Conditions

Another critical factor to consider before refinancing your car loan is the current interest rates and market conditions. Interest rates fluctuate over time, and if the current rates are lower than the rate on your existing loan, refinancing could potentially save you money.

However, it's essential to research and compare interest rates from different lenders to ensure that you are getting the best deal possible. Additionally, market conditions can also impact the availability of refinancing options, so it's crucial to keep an eye on the market before making a decision.

Steps to Refinance a Car Loan Without Hurting Credit Score

When considering refinancing your car loan, it is essential to do so in a way that minimizes the impact on your credit score. Follow these steps to refinance your car loan without negatively affecting your credit.

Research and Compare Refinancing Options

- Start by researching different lenders and their refinancing options.

- Compare interest rates, terms, and fees to find the best deal that suits your financial situation.

- Look for lenders that offer pre-qualification without affecting your credit score.

Apply for Refinancing Smartly

- Submit applications to lenders within a short period to minimize the impact of multiple credit inquiries.

- Consider applying to credit unions or online lenders that use soft credit checks initially.

- Ensure that the lender pulls your credit report only once you are ready to proceed with the application.

Negotiate Terms and Finalize the Refinancing

- Once you receive offers from lenders, negotiate terms such as interest rates and repayment schedules.

- Choose the best offer that meets your needs and finalize the refinancing process with the selected lender.

- Review the new loan agreement carefully to ensure all terms are as agreed upon before signing.

Alternatives to Car Loan Refinancing

When considering options other than refinancing your car loan, there are a few alternatives to explore that may suit your financial situation better.

Pay off the Loan Early

If you find yourself in a better financial position than when you initially took out the car loan, paying it off early can save you money on interest payments. This alternative can help you avoid the hassle of refinancing and potentially improve your credit score.

Negotiate with Your Current Lender

Before jumping into refinancing, try negotiating with your current lender for better loan terms. They might be willing to lower your interest rate or adjust the repayment schedule to better fit your needs. This can be a quicker and easier solution compared to refinancing.

Take Out a Personal Loan

If your credit score has improved since you took out the car loan, you might qualify for a lower interest rate on a personal loan. Using this loan to pay off your car loan can help you save money in the long run.

However, make sure to compare the terms and fees of both loans before making a decision.

Sell or Trade-In Your Car

If you find yourself struggling to make car loan payments, selling or trading in your car for a more affordable option can be a viable alternative. By downsizing or opting for a used vehicle, you can potentially eliminate the need for refinancing altogether.

Closing Summary

The content of the concluding paragraph that provides a summary and last thoughts in an engaging manner

FAQ Explained

What impact does refinancing a car loan have on interest rates and monthly payments?

Refinancing a car loan can potentially lower the interest rate, resulting in lower monthly payments. However, it's important to consider any fees associated with the refinance.

How does credit score influence the refinancing process?

Credit score plays a significant role in determining the interest rate offered for the refinanced loan. A higher credit score often leads to better terms.

What are some alternative options to car loan refinancing?

Alternatives may include negotiating with the current lender for better terms, seeking a loan modification, or selling the car to pay off the loan. Each option has its own benefits and drawbacks.