Secure Payment Gateways and Merchant Services 2025: Navigating the Future of Payment Security

As we delve into the realm of Secure Payment Gateways and Merchant Services 2025, we uncover a landscape brimming with innovation and challenges. From the evolution of payment technologies to the impact of regulatory frameworks, this topic promises a captivating journey into the future of secure transactions.

Secure Payment Gateways and Merchant Services have become integral to the digital economy, shaping the way businesses and consumers interact in the online marketplace. By exploring the latest trends and advancements, we gain valuable insights into how payment security is set to evolve by 2025.

Introduction to Secure Payment Gateways and Merchant Services 2025

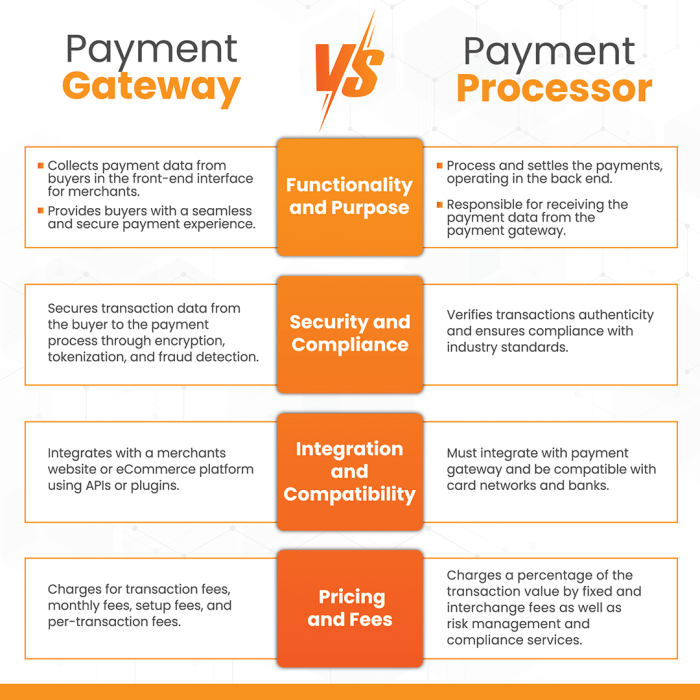

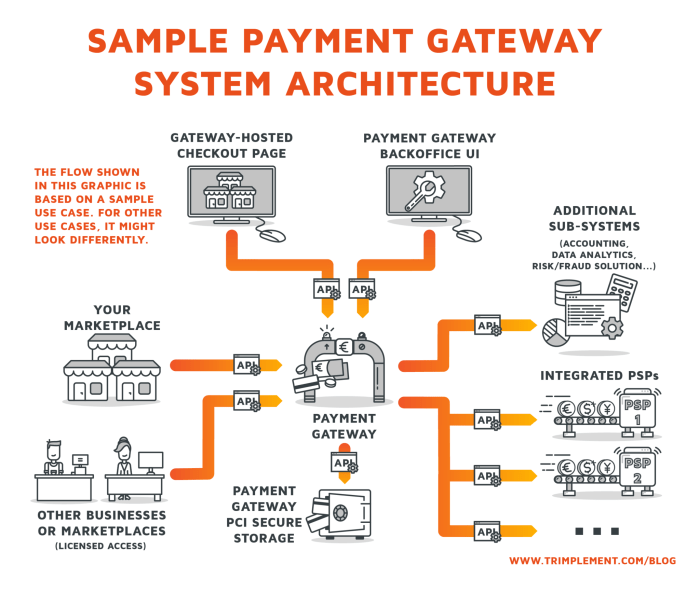

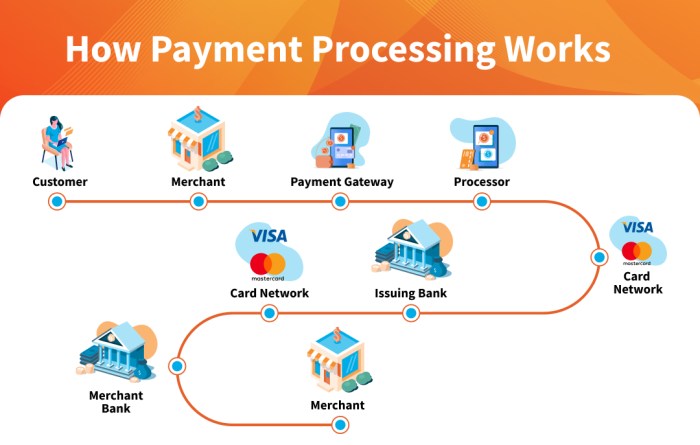

Secure payment gateways and merchant services play a crucial role in facilitating online transactions in a safe and efficient manner. These services provide a secure platform for customers to make payments and for businesses to receive funds, ensuring a smooth and trustworthy e-commerce experience.

The importance of secure payment gateways in e-commerce transactions cannot be overstated. With the increasing prevalence of online shopping, customers need to feel confident that their sensitive information, such as credit card details, is protected from cyber threats and fraud.

Secure payment gateways encrypt data during transactions, reducing the risk of unauthorized access and ensuring the confidentiality of customer information.

Evolution of Merchant Services and Payment Gateways by 2025

By 2025, merchant services and payment gateways are expected to undergo significant advancements to enhance security, speed, and convenience for both businesses and consumers. Innovations such as biometric authentication, tokenization, and artificial intelligence will likely be integrated into payment systems to strengthen security measures and streamline the payment process.

- Biometric authentication: Biometric technology, such as fingerprint or facial recognition, will be increasingly used to verify the identity of users during payment transactions, adding an extra layer of security.

- Tokenization: Tokenization replaces sensitive card information with a unique token that is used for transactions, reducing the risk of data theft and enhancing the security of online payments.

- Artificial intelligence: AI algorithms will be utilized to analyze transaction patterns and detect any suspicious activities, helping to prevent fraudulent transactions and protect both merchants and customers.

Trends in Payment Security Technologies

As technology continues to evolve, so do the methods used to enhance payment security. In today's digital age, staying ahead of potential threats is crucial for businesses and consumers alike.

Biometric Authentication

Biometric authentication is revolutionizing secure payment processes by providing an additional layer of security that is unique to each individual. This technology uses physical characteristics such as fingerprints, facial recognition, or iris scans to verify a person's identity before authorizing a payment transaction.

Unlike traditional methods like passwords or PINs, biometric data cannot be easily replicated, making it a more secure option for authentication.

Blockchain Technology

Blockchain technology is playing a significant role in securing payment transactions by providing a decentralized and tamper-proof record of transactions. By using a distributed ledger system, blockchain ensures that all payment data is encrypted and stored across a network of computers, making it nearly impossible for hackers to alter or steal sensitive information.

This technology increases transparency, reduces the risk of fraud, and enhances the overall security of payment processes.

Regulatory Landscape Impacting Secure Payment Gateways

The regulatory landscape plays a crucial role in shaping the operations of secure payment gateways in 2025. Various key regulations and compliance standards significantly impact the way these systems are designed and operated to ensure the security of transactions and sensitive data.

Data Protection Laws and Secure Payment Systems

Data protection laws, such as the General Data Protection Regulation (GDPR) in the European Union, have a profound influence on the design of secure payment systems. These laws mandate strict requirements for the collection, processing, and storage of personal data, including payment information.

As a result, payment gateways need to implement robust security measures to ensure compliance with these regulations, such as encryption, tokenization, and secure authentication protocols.

Global Regulations and Cross-Border Payment Security

The implications of global regulations on cross-border payment security are significant for payment gateways operating on an international scale. Different countries have varying regulations regarding data protection, privacy, and financial transactions, which can pose challenges for ensuring consistent security standards across borders.

Payment gateways must navigate these complex regulatory environments to maintain the integrity and security of cross-border transactions, often requiring tailored solutions and partnerships with local entities to ensure compliance

Advancements in Fraud Detection and Prevention

Fraud detection and prevention are crucial aspects of ensuring secure payment gateways and merchant services. With the constant evolution of technology, new tools and strategies have emerged to combat fraudulent activities and safeguard sensitive payment data.

Use of AI and Machine Learning

AI and machine learning have revolutionized the way fraud detection is approached in the payment industry. These technologies enable systems to analyze vast amounts of data in real-time, identifying patterns and anomalies that may indicate fraudulent behavior. By continuously learning and adapting to new threats, AI-powered solutions can enhance fraud detection capabilities and minimize false positives.

Effectiveness of Tokenization

Tokenization is another powerful tool in securing payment data and preventing fraud. By replacing sensitive information such as credit card numbers with unique tokens, tokenization ensures that even if a data breach occurs, the stolen data holds no value to cybercriminals.

This method significantly reduces the risk of unauthorized access to payment information and enhances overall security.

Enhanced Authentication Methods

Advancements in fraud detection also include the implementation of enhanced authentication methods such as biometrics and multi-factor authentication. These additional layers of security help verify the identity of users and prevent unauthorized access to payment accounts. Biometric technologies like fingerprint scanning and facial recognition offer a more secure and convenient way for users to authenticate their transactions, reducing the risk of fraudulent activities.

Real-time Monitoring and Alerts

Real-time monitoring and alerts play a crucial role in fraud detection and prevention. By continuously monitoring transactions for suspicious activities and triggering alerts for potential fraud, payment gateways can quickly respond to threats and mitigate risks. This proactive approach allows businesses to stay one step ahead of fraudsters and protect their customers' sensitive data.

Customer Experience and Payment Security

In today's digital age, where online transactions are prevalent, ensuring secure payment gateways is crucial for building customer trust and loyalty. Customers expect their payment information to be safeguarded against cyber threats, and any breach could have a significant impact on their confidence in a business.

Impact of Secure Payment Gateways on Customer Trust and Loyalty

Secure payment gateways play a vital role in enhancing customer trust and loyalty. When customers feel confident that their payment information is protected, they are more likely to make repeat purchases and recommend the business to others. On the other hand, a security breach can lead to a loss of trust and ultimately drive customers away.

Balance Between Security Measures and Seamless Payment Experiences

Finding the right balance between implementing strong security measures and providing a seamless payment experience is crucial. While robust security protocols are necessary to protect customer data, overly complex verification processes can frustrate customers and lead to cart abandonment. Businesses must prioritize both security and user experience to maintain customer satisfaction.

Educating Consumers About Secure Payment Practices

It is essential to educate consumers about the importance of secure payment practices to help them understand the risks associated with online transactions. Businesses can provide tips on creating strong passwords, recognizing phishing attempts, and using secure payment methods to empower customers to protect themselves.

By raising awareness, businesses can build a more secure online ecosystem for both customers and merchants.

Last Word

In conclusion, Secure Payment Gateways and Merchant Services 2025 are poised to redefine the landscape of online transactions, offering a blend of robust security measures and enhanced user experiences. As technology continues to evolve, businesses and consumers alike must stay vigilant and adapt to the changing payment ecosystem to ensure safe and seamless transactions in the years to come.

Question Bank

What are secure payment gateways?

Secure payment gateways are online platforms that facilitate the transfer of sensitive payment information between a customer and a merchant securely.

How do data protection laws impact secure payment systems?

Data protection laws dictate how businesses handle and secure customer data, influencing the design and implementation of secure payment systems to ensure compliance.

What role does biometric authentication play in secure payment processes?

Biometric authentication utilizes unique physical traits such as fingerprints or facial recognition to verify user identity, adding an extra layer of security to payment transactions.