Shopify Financing Options Explained for New Sellers

By admin

6 mins to read

Shopify Financing Options Explained for New Sellers sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

The content of the second paragraph that provides descriptive and clear information about the topic

Table of Contents

ToggleOverview of Shopify Financing Options

When starting out as a new seller on Shopify, it's important to consider the various financing options available to help you grow your business. Let's explore the different financing options and how they can benefit you as a new seller.

Shopify Capital

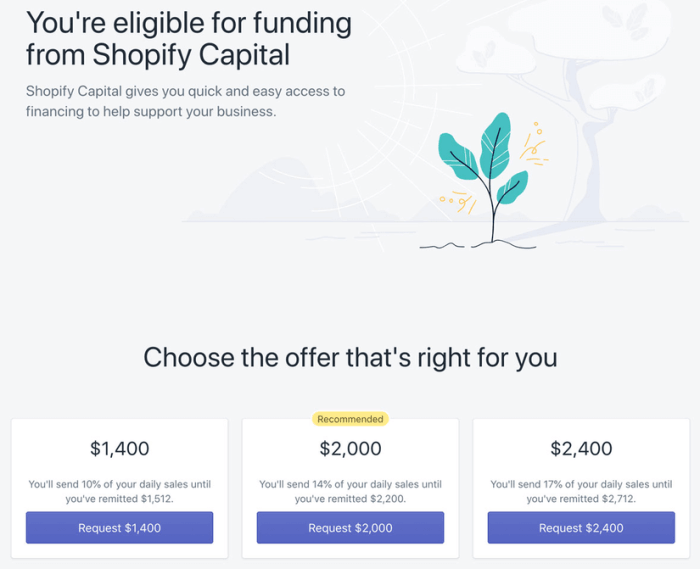

One financing option available to Shopify sellers is Shopify Capital. This option offers cash advances to eligible merchants based on their past sales performance on the platform. The amount of funding is determined by Shopify, and the advance is repaid through a percentage of future sales.

This can be a convenient option for new sellers looking to invest in inventory, marketing, or other business needs without taking out a traditional loan.

Buy Now, Pay Later

Another financing option on Shopify is Buy Now, Pay Later services like Afterpay or Klarna. These services allow customers to make purchases and pay for them in installments over time. As a seller, offering Buy Now, Pay Later options can attract more customers and increase sales, especially for higher-priced items that customers may not be able to afford upfront.

Third-Party Financing Apps

Shopify also integrates with various third-party financing apps that allow sellers to offer customized financing options to their customers. These apps provide flexibility in terms of payment plans, interest rates, and eligibility criteria, giving sellers the ability to cater to a wider range of customers and increase sales.

Shopify Capital

Shopify Capital is a financing option offered by Shopify to help eligible sellers grow their businesses. It provides funds to sellers based on their sales history and performance on the platform.

What is Shopify Capital and How Does it Work?

Shopify Capital works by offering cash advances to sellers, which are then paid back through a percentage of their daily sales. The amount of the advance is determined by factors such as the seller's revenue history, store performance, and overall business health.

Sellers can use the funds for various purposes, such as inventory restocking, marketing campaigns, or expanding their product line.

Eligibility Criteria for Shopify Capital

- Sellers must have a history of sales on the Shopify platform.

- Minimum revenue thresholds may apply.

- Good standing with Shopify, including no outstanding fees or penalties.

Advantages and Disadvantages of Using Shopify Capital for Financing

Using Shopify Capital can provide sellers with quick access to funds without the need for a credit check or lengthy application process. Additionally, the repayment structure based on a percentage of daily sales can be convenient for sellers with fluctuating revenue.

However, some disadvantages include potentially higher fees compared to traditional loans and the risk of daily sales being impacted by the repayment structure.

Buy Now, Pay Later Options

When it comes to offering flexible payment options to customers, Shopify also provides buy now, pay later services. These options allow customers to make a purchase and defer the payment to a later date, making it easier for them to manage their finances while still getting the products they want.

Key Features of Buy Now, Pay Later Services

- Instant Approval: Customers can quickly get approved for buy now, pay later options without the hassle of a lengthy application process.

- Interest-Free Periods: Some buy now, pay later services offer interest-free periods, allowing customers to spread out their payments without incurring extra costs.

- Increased Conversion Rates: By offering flexible payment options, sellers can attract more customers and increase their conversion rates.

Success Stories of New Sellers

Many new sellers on Shopify have reported a significant boost in sales after implementing buy now, pay later options. By giving customers the flexibility to pay at a later date, these sellers have seen an increase in average order value and repeat purchases.

This shows the effectiveness of offering such payment solutions in driving sales and growing a business.

Alternative Financing Sources

When looking for financing options as a new Shopify seller, it's essential to explore alternative sources beyond traditional methods. These alternative financing sources can provide flexibility and tailored solutions to meet your specific needs.

Crowdfunding

Crowdfunding platforms like Kickstarter or Indiegogo allow you to raise funds by showcasing your products or business idea to a large audience. Supporters can contribute money in exchange for rewards or early access to your products. To access crowdfunding, create a compelling campaign with clear goals, rewards, and a strong marketing strategy to attract backers.

Peer-to-Peer Lending

Peer-to-peer lending platforms like LendingClub or Prosper connect borrowers directly with individual lenders. To access peer-to-peer lending, create a profile detailing your business and financing needs. Investors will then review your profile and decide whether to fund your loan. Be prepared to provide detailed information about your business and financial situation.

Small Business Grants

Government agencies, non-profit organizations, and corporations offer small business grants to support entrepreneurship and innovation. To access small business grants, research available opportunities, carefully review eligibility requirements, and submit a compelling grant proposal. Keep in mind that competition for grants can be fierce, so make sure your proposal stands out.

Invoice Financing

Invoice financing allows you to borrow money against outstanding invoices to improve your cash flow. Platforms like Fundbox or BlueVine offer invoice financing services for small businesses. To access invoice financing, create an account on the platform, link your accounting software or invoices, and submit a funding request.

Keep in mind that invoice financing can be more expensive than traditional loans.

Risks of Alternative Financing Sources

While alternative financing sources can provide valuable funding options for new Shopify sellers, there are risks to consider. These include higher interest rates, stricter repayment terms, and potential scams or fraudulent schemes. Before pursuing alternative financing, carefully research each option, compare terms and fees, and ensure the legitimacy of the provider to protect your business and finances.

Final Wrap-Up

The content of the concluding paragraph that provides a summary and last thoughts in an engaging manner

Helpful Answers

What are the different financing options available to new sellers on Shopify?

Answer

What is Shopify Capital and how does it work?

Answer

What are the eligibility criteria for Shopify Capital?

Answer

What are the risks associated with using alternative financing sources for new Shopify sellers?

Answer

Related posts

Shopify Capital Loan Tips for Small Business Owners: A Comprehensive Guide

Inventory Tracking for Ecommerce: BigCommerce, Shopify, and Beyond

Shopify Ads Not Converting? Hire the Right Ecommerce PPC Experts

Magento 2 vs Shopify: Which Platform Wins for Custom Development?

Featured Posts

Tags

2025 (3) AI (4) Beauty Standards (4) BigCommerce (7) Comparison (3) Custom Development (2) Digital Marketing (3) E-commerce (14) Ecommerce (11) Finance (2) global ecommerce (2) home automation (2) home improvement (7) Inventory Management (6) landscaping (2) Magento (3) Magento 2 (7) Online Advertising (2) online business (3) online payments (2) online retail (2) online store (2) Online Transactions (3) Outdoor living (3) payment processing (2) PPC (6) real estate (4) Shopify (6) Smart Home Technology (3) technology (3)

Categories

- Automotive (4)

- Beauty (4)

- Beauty and AI (1)

- Business (4)

- Car Maintenance (2)

- Car Warranties (1)

- Construction (1)

- Culture and Society (1)

- Design (1)

- Digital Commerce (1)

- Digital Marketing (8)

- Digital Transactions (1)

- E-commerce (6)

- E-commerce Development (1)

- E-commerce Operations (1)

- E-commerce Solutions (2)

- E-commerce Tools (2)

- eCommerce (3)

- Ecommerce Development (1)

- Ecommerce Platforms (2)

- Ecommerce Services (1)

- Financial Tips (1)

- General (78)

- Home Improvement (13)

- Home Security (2)

- Insurance Claims (1)

- Luxury Property Management (1)

- Online Branding (1)

- Online Business (1)

- Outdoor Living (1)

- Personal Finance (1)

- Photography (1)

- Property Management (3)

- Real Estate (3)

- Technology (2)

- Web Development (2)