Shopify Capital Loan Tips for Small Business Owners: A Comprehensive Guide

Embark on a journey through the realm of Shopify Capital Loan Tips for Small Business Owners, where valuable insights and strategies await to empower entrepreneurs in their financial endeavors.

Delve into the intricacies of Shopify Capital Loans and discover how they can revolutionize the landscape for small business owners seeking financial assistance.

Understanding Shopify Capital Loans

Shopify Capital Loans are financial assistance options offered by Shopify to small business owners to help them grow and expand their businesses. These loans are specifically tailored to the needs of e-commerce businesses operating on the Shopify platform.

Eligibility Criteria for Shopify Capital Loans

- Must be a registered business on the Shopify platform.

- Minimum monthly revenue threshold must be met.

- Good standing in terms of payment processing and order fulfillment.

- Consistent sales and growth potential demonstrated in the business.

Application Process for Shopify Capital Loans

Applying for a Shopify Capital Loan is a straightforward process designed to provide quick access to funds for eligible businesses.

- Log in to your Shopify account and navigate to the Capital tab.

- Check your eligibility and view the loan offer details.

- Review and accept the terms and conditions of the loan.

- Receive the funds directly into your business account.

Benefits of Shopify Capital Loans

Shopify Capital Loans offer several advantages to small business owners looking for financial support to grow their businesses.

Advantages of Shopify Capital Loans

- Quick and Easy Application Process: Shopify Capital Loans have a streamlined application process compared to traditional loans, making it convenient for small business owners to access funds quickly.

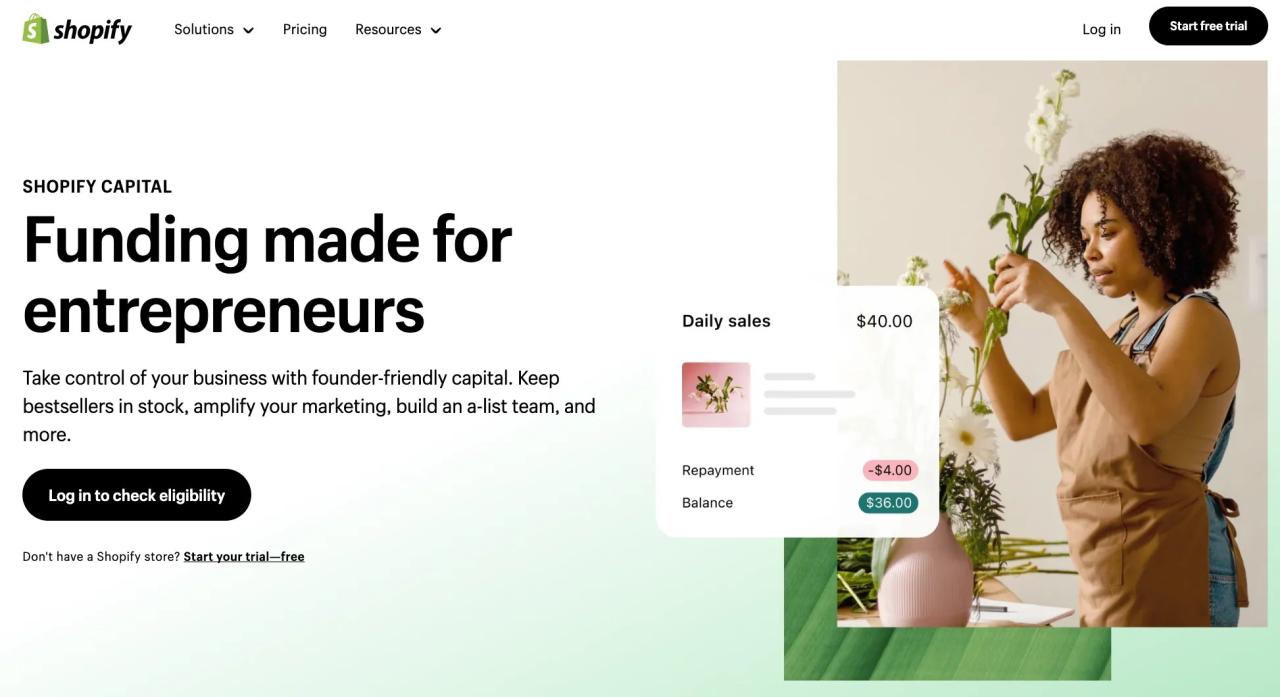

- No Fixed Monthly Payments: Unlike traditional loans, Shopify Capital Loans offer flexible repayment options based on a percentage of daily sales, which can be beneficial during slower months.

- No Personal Guarantees: Small business owners can secure Shopify Capital Loans without providing personal guarantees or collateral, reducing the personal risk involved.

- Customized Funding Offers: Shopify analyzes the business performance data of the merchant to provide tailored funding offers that suit their individual needs and growth plans.

How Shopify Capital Loans Help Business Growth

- Expansion Opportunities: With access to quick funding, small business owners can invest in inventory, marketing, or equipment to expand their operations and reach a larger customer base.

- Seasonal Support: The flexible repayment structure of Shopify Capital Loans allows businesses to manage cash flow effectively, especially during seasonal fluctuations in sales.

- Innovation and Investment: Small business owners can use Shopify Capital Loans to innovate, improve their products or services, and invest in technology to stay competitive in the market.

Flexibility and Repayment Options

- Automatic Repayments: Shopify Capital Loans are repaid automatically through a percentage of daily sales, eliminating the need for manual payments and reducing administrative tasks.

- No Fixed Terms: Small business owners have the flexibility to repay the loan faster when sales are high or take longer during slower periods, aligning with their business cash flow.

- No Hidden Fees: Shopify Capital Loans have transparent pricing with no hidden fees, providing clarity for business owners on the total cost of borrowing.

Managing Shopify Capital Loan Funds

Once a small business owner secures a Shopify Capital Loan, it is crucial to have a clear plan in place for effectively allocating and utilizing the funds received. Proper management of these funds can significantly impact the growth and success of the business.

Tracking Expenses and Managing Cash Flow

It is essential to track all expenses diligently and maintain a detailed record of where the funds are being utilized. By keeping a close eye on cash flow, business owners can ensure that the funds are being used efficiently and effectively

- Implement a robust accounting system to track all expenses and income related to the Shopify Capital Loan.

- Regularly review financial statements to identify any areas of overspending or opportunities for cost-saving.

- Utilize budgeting tools to allocate funds to different areas of the business strategically.

Maximizing the Impact of Shopify Capital Loan Funds

To maximize the impact of the Shopify Capital Loan funds, small business owners can consider the following strategies:

- Invest in marketing and advertising campaigns to reach a broader audience and attract more customers.

- Upgrade or purchase new equipment to improve operational efficiency and productivity.

- Expand product lines or services to diversify revenue streams and capture new market opportunities.

- Hire additional staff or invest in training programs to enhance the skills and capabilities of the workforce.

- Explore new growth opportunities, such as entering new markets or launching an e-commerce platform.

Repaying Shopify Capital Loans

Repaying Shopify Capital Loans is a crucial part of the borrowing process for small business owners. It is essential to understand the repayment terms and conditions associated with these loans to avoid any financial setbacks.

Repayment Terms and Conditions

- Shopify Capital Loans typically have fixed daily or weekly repayment schedules, where a percentage of your daily sales is deducted until the loan is fully repaid.

- There are no late fees or penalties for early repayment, giving borrowers flexibility in managing their finances.

- It is important to review and understand the repayment terms before accepting the loan offer to ensure that it aligns with your business cash flow.

Different Repayment Options

- Automatic Repayment: Shopify Capital Loans offer automatic repayment, where the loan amount is deducted directly from your daily sales, making it a convenient option for many small business owners.

- Manual Repayment: If you prefer more control over your repayments, you can choose to manually repay the loan amount at your discretion, as long as you meet the minimum repayment requirements.

Tips for Timely Repayment

- Monitor your sales and cash flow regularly to ensure that you have enough funds to cover the loan repayment amounts.

- Set aside a portion of your daily sales specifically for loan repayment to avoid falling behind on payments.

- Communicate with Shopify Capital if you anticipate any challenges in repaying the loan, as they may offer flexible solutions to help you stay on track.

Closure

In conclusion, navigating the world of Shopify Capital Loans can be a game-changer for small business owners looking to expand their ventures. Armed with the right knowledge and tips, success is within reach.

FAQ

What are the eligibility criteria for a Shopify Capital Loan?

Small business owners need to have a certain minimum revenue threshold and a history of sales on Shopify to qualify for a Shopify Capital Loan.

How can small business owners effectively manage Shopify Capital Loan funds?

Creating a detailed plan for fund allocation, tracking expenses meticulously, and implementing successful strategies are key to effectively managing Shopify Capital Loan funds.

What are the repayment terms for Shopify Capital Loans?

Repayment terms for Shopify Capital Loans vary but typically involve a percentage of daily sales until the loan amount is repaid in full.