How to Lower Transaction Fees with the Right Ecommerce Merchant Provider

How to Lower Transaction Fees with the Right Ecommerce Merchant Provider sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

Choosing the right merchant provider is crucial for optimizing transaction costs and maximizing savings. Negotiating fees, understanding fee structures, and utilizing technology are key strategies that can make a significant difference. Let's delve deeper into these aspects to uncover valuable insights.

Choosing the Right Ecommerce Merchant Provider

When it comes to running an online business, selecting the appropriate ecommerce merchant provider is crucial for various reasons. The right provider can not only streamline your payment processes but also help in reducing transaction fees, ultimately impacting your bottom line.

Key Factors to Consider

- Compatibility with Your Ecommerce Platform: Ensure the merchant provider integrates seamlessly with your chosen ecommerce platform to facilitate smooth transactions.

- Security Features: Look for providers that offer robust security measures to protect sensitive customer data and prevent fraud.

- Transaction Fees Structure: Compare the fee structures of different providers to find one that offers competitive rates and transparency.

- Customer Support: Opt for a provider that offers reliable customer support to address any issues promptly.

- Scalability: Choose a provider that can scale with your business as it grows, accommodating increased transaction volumes.

Lowering Transaction Fees

The right ecommerce merchant provider can help lower transaction fees through negotiated rates, volume discounts, and optimized payment processing solutions.

By selecting a provider that offers cost-effective pricing models and value-added services, you can effectively reduce the impact of transaction fees on your profitability.

Negotiating Transaction Fees

When it comes to negotiating transaction fees with your ecommerce merchant provider, there are several strategies you can employ to potentially lower your costs and increase your profit margins.

Leveraging Transaction Volume

One effective way to negotiate lower transaction fees is by leveraging your transaction volume. Merchant providers are often willing to offer discounted rates to businesses that process a high volume of transactions. By demonstrating a consistent and substantial transaction volume, you can make a strong case for lower fees.

Another tip is to consider bundling your services with a single provider. If you use the same provider for multiple services such as payment processing, point-of-sale systems, and ecommerce platforms, you may be able to negotiate a better overall rate for all services combined.

Furthermore, be sure to review your contract terms regularly and stay informed about industry trends. This will help you identify opportunities to renegotiate your rates based on changes in the market or your business's performance.

Impact of Negotiation

- Reduced Costs: Negotiating lower transaction fees can significantly impact your bottom line by reducing your overall processing costs. Even a small reduction in fees can add up to substantial savings over time.

- Competitive Advantage: Lower transaction fees can give you a competitive advantage by allowing you to offer better pricing to your customers or invest more in marketing and business growth.

- Improved Profit Margins: By negotiating better rates with your merchant provider, you can improve your profit margins and increase the profitability of your ecommerce business.

Understanding Fee Structures

When it comes to choosing an ecommerce merchant provider, understanding fee structures is crucial in order to lower transaction fees and maximize cost savings. Different fee structures are commonly used in the industry, with two main types being flat-rate fees and interchange-plus pricing models for transaction fees.

Flat-Rate Fees

Flat-rate fees involve a fixed percentage of the transaction value and a set per-transaction fee. This structure simplifies pricing and is easy to understand for merchants. However, it may not always be the most cost-effective option, especially for high-volume businesses or those with larger transaction sizes.

- Easy to understand and calculate

- May be more expensive for high-volume businesses

- Less transparency compared to interchange-plus pricing

Interchange-Plus Pricing Models

Interchange-plus pricing models involve passing the actual interchange fees set by card networks directly to the merchant, along with a markup fee from the provider. This results in more transparency and potentially lower costs for merchants, especially for those processing a high volume of transactions or higher-value transactions.

- More transparency in pricing

- Potentially lower costs for high-volume or high-value transactions

- Can be more complex to understand compared to flat-rate fees

By understanding the differences between flat-rate fees and interchange-plus pricing models, merchants can make informed decisions that lead to significant cost savings over time. It's important to consider factors such as transaction volume, average transaction size, and the specific needs of the business when choosing the right fee structure for an ecommerce merchant provider.

Utilizing Technology to Lower Fees

When it comes to lowering transaction fees in ecommerce, leveraging technology can be a game-changer. By utilizing payment processing technology, businesses can streamline operations and reduce costs significantly.

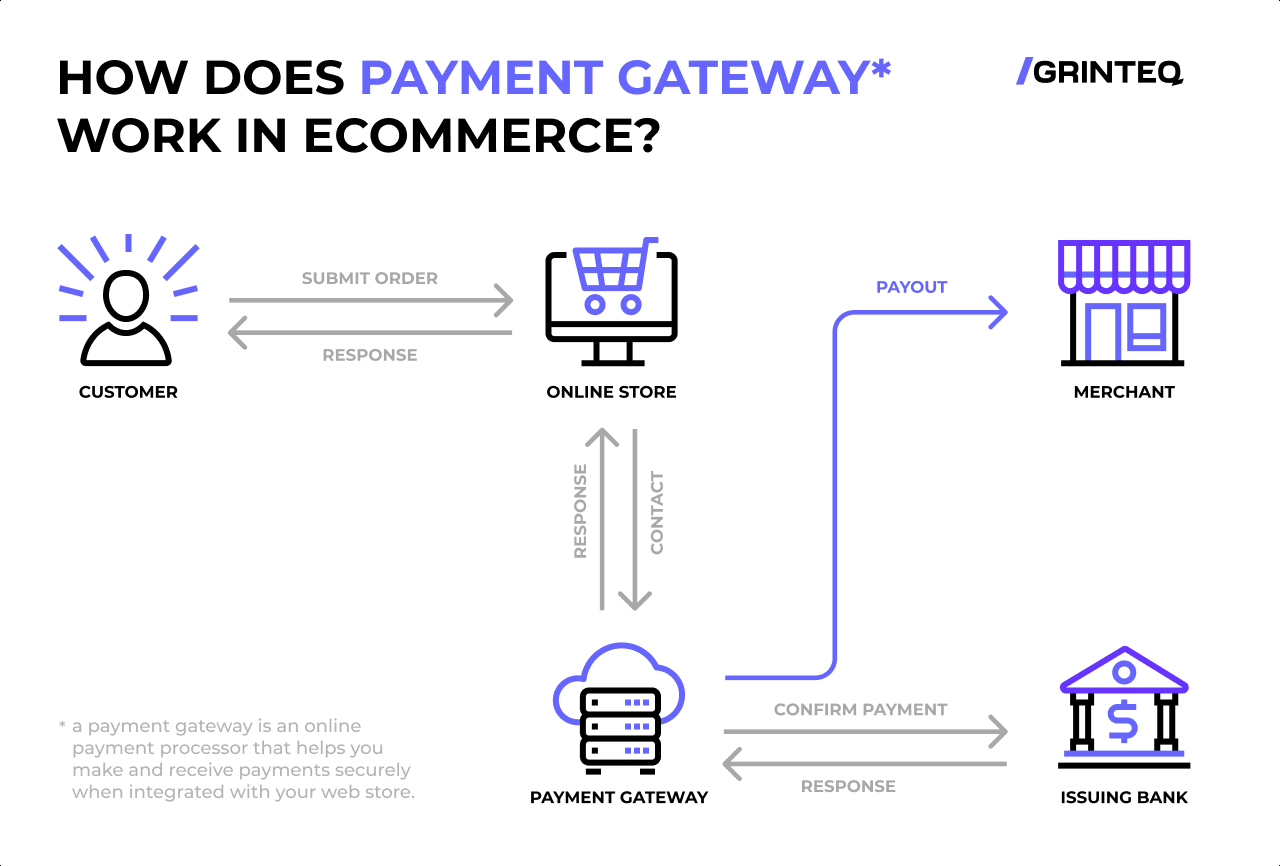

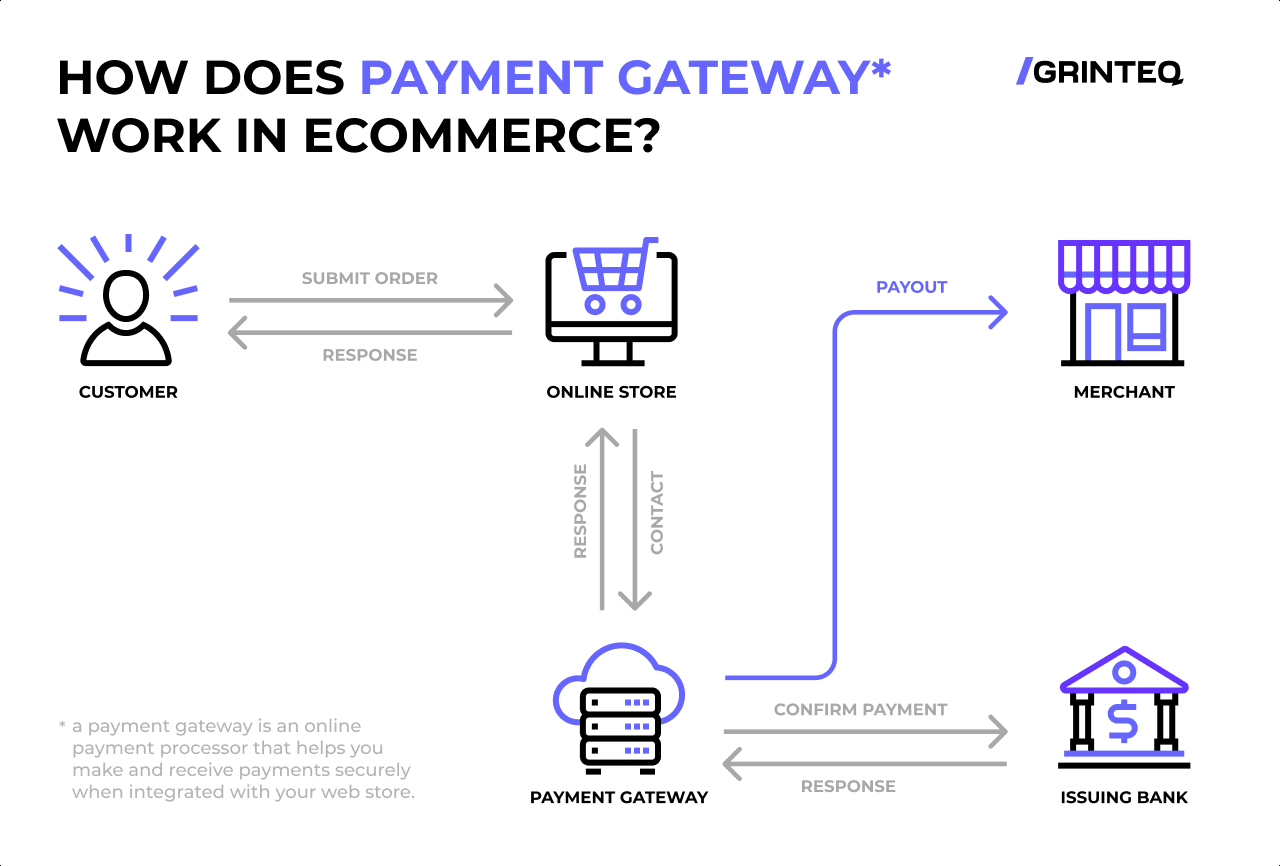

Role of Payment Gateways

Payment gateways play a crucial role in processing online transactions securely and efficiently. These gateways act as the middlemen between the merchant's website and the payment processor, ensuring that sensitive payment information is transmitted securely. By choosing a payment gateway that offers competitive rates and efficient processing, businesses can lower their transaction fees.

Technology Solutions for Fee Optimization

- Implementing Tokenization: Tokenization replaces sensitive card data with a unique token, reducing the risk of data breaches and fraud. This technology can help businesses qualify for lower interchange rates, ultimately reducing transaction fees.

- Utilizing Fraud Prevention Tools: Investing in fraud prevention tools can help businesses identify and prevent fraudulent transactions. By minimizing chargebacks and fraudulent activities, businesses can lower their overall transaction costs.

- Integrating with Accounting Software: Integrating payment processing technology with accounting software can streamline financial processes and reduce manual errors. This automation can lead to cost savings and improved efficiency in fee management.

Last Point

In conclusion, mastering the art of lowering transaction fees with the right ecommerce merchant provider is a game-changer for businesses looking to enhance profitability. By implementing the strategies discussed, businesses can navigate the complex landscape of transaction fees with confidence and efficiency.

FAQ Explained

How can I choose the right ecommerce merchant provider for my business?

Consider factors like your business needs, fees, integrations, and customer support before making a decision.

What are some effective strategies for negotiating transaction fees?

Increasing transaction volume and comparing offers from different providers can give you leverage during negotiations.

What is the difference between flat-rate fees and interchange-plus pricing models?

Flat-rate fees charge a fixed percentage per transaction, while interchange-plus pricing includes interchange fees plus a markup.

How can technology help in lowering transaction costs?

Payment processing technology and optimized fee management solutions can streamline processes and reduce fees.